VIDEO

Brian takes a deeper dive into the recet interest rate hikes and what it means for the local real estate market.

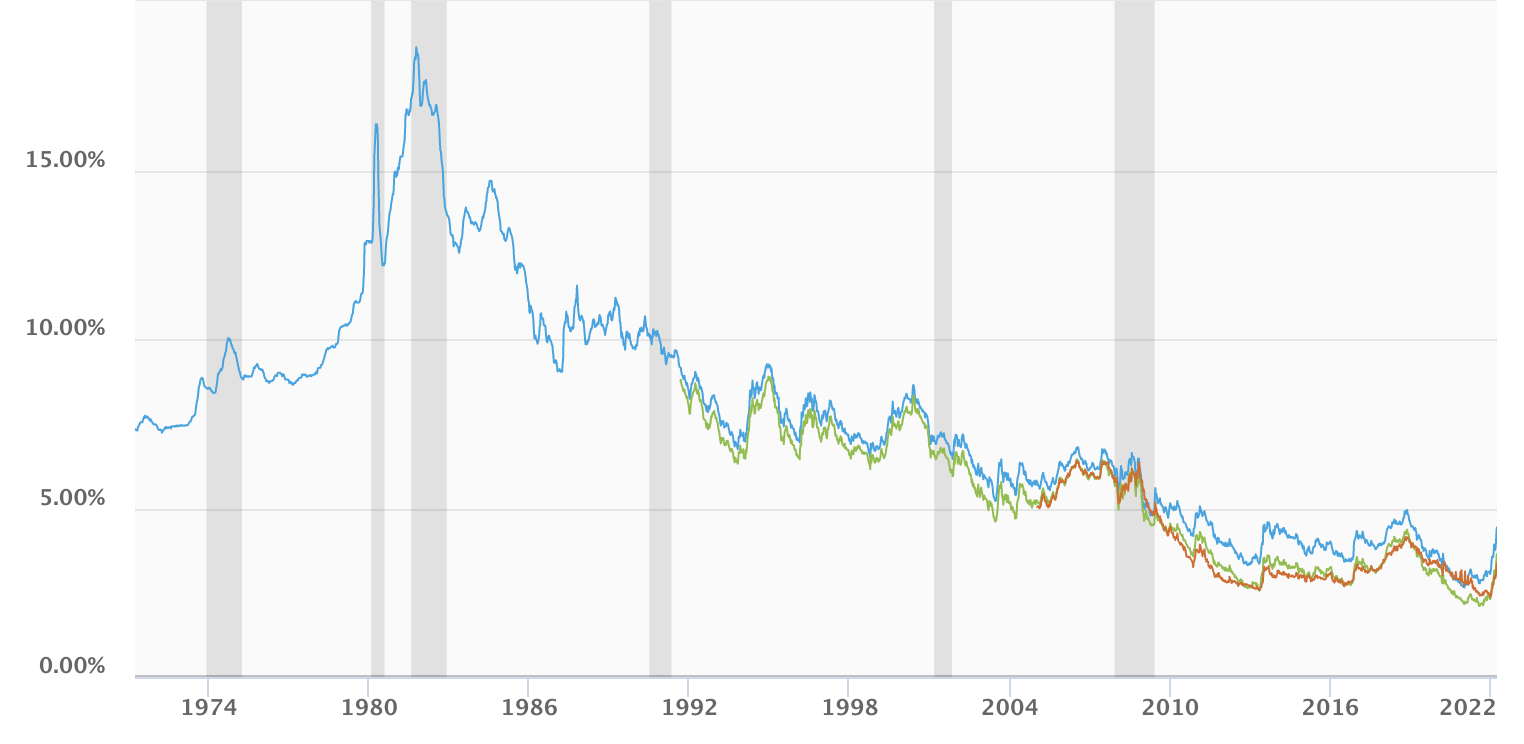

This was not unexpected. We’ve known for several years now that we were on a path to higher mortgage interest rates.

The Federal Reserve has also been making it clear through their monetary policies that higher mortgage ineterest rates were coming sooner, rather than later.

The fundamentals of the real estate market remain strong, and it will take a lot more than higher interest rates to throw the housing market into recession.

Mortgage interest rates in the 2-3% range never have been, and never were going to be, the new normal.

Historically speaking, rates in the 5-6% range and more the norm than 2-3%.

Even if rates normalize back to the 5-6% range, those are rates that keep housing affordable.

The good news is for most home buyers, they qualify for more than they actually want to spend on a home.

So while increased interest rates will result in a higher payment, it will not stop most home buyers from buying the home they want. Location, school district, etc. will remain more important for most home buyers than an incremental rise in monthly payment.

Even if rates normalize in the 5-6% range, for most people the monthly payment associated with buying a home versus renting a home strongly favors home ownership.

Add in the fact that in adition to a better monthly payment, homeowners build wealth through equity gains.

These factors will keep home ownership at the forefront of housing plans for the majority of Americans.

If you read our 2022 Housing Market Forecast at the beginning of the year, you already know these rate hikes were in the works.

While 5% mortgage rates have certainly arrived faster than we expected, the bottom line is by the end of the year we expected rates to be hovering near 5% and we expected home value growth to be positive, but at a slower pace than the past few years.

Both those assumptions still hold true. While we expect some buyers to get squeezed out of the market due to rising rates, enough buyers will remian for strong housing demand to stay intact. Perhaps a bonus for buyers might be the cooling off of bidding wars that make it difficult to get offers accepted as the supply/demand balance of housing normalizes.